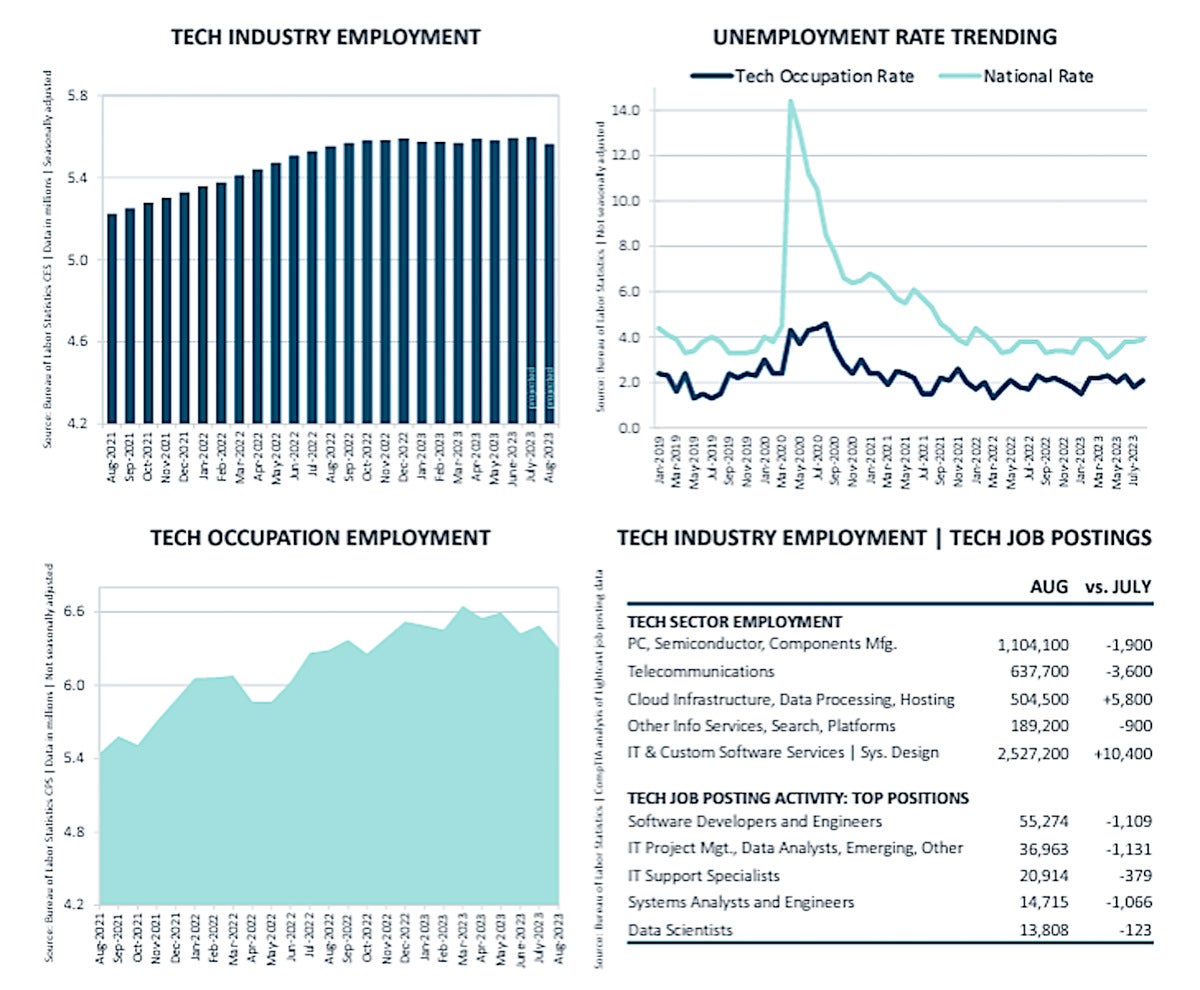

US unemployment in the technology sector increased by 0.2% to 3.5% last month, following an upward trend in joblessness in all sectors.

Technology occupations across the economy declined by an estimated 133,000 positions, according to a new report from IT industry group CompTIA.

Overall, the US unemployment rate among all job markets rose by 0.2% to 3.9% in February, and the number of unemployed people increased by 334,000 to 6.5 million. A year earlier, the jobless rate was 3.6%, and the number of unemployed people was 6 million. While unemployment did tick up, February’s rate continued the longest stretch of unemployment below 4% in decades.

There were 275,000 jobs added to the US market last month, according to the US Bureau of Labor Statistics (BLS) report today. The data shows a significant uptick over January’s 229,000 jobs added to the workforce, but lower than December’s numbers, when 290,000 jobs were added.

“New hiring of tech services and software development personnel is the lone bright spot in February’s lackluster technology employment data,” said Tim Herbert, chief research officer at IT industry group CompTIA.

CompTIA

CompTIAOverall tech industry employment increased modestly, employer job postings for future tech hiring were flat, tech occupations throughout the economy declined, according to CompTIA’s latest jobs report.

“We continue to see the lag effect of market developments working their way into government employment data,” Hebert said. “While employers across every sector of the economy demand tech talent spanning the continuum of tech job roles, there are pockets of employers recalibrating their staffing levels.”

IT business consultancy Janco Associates had a similar take on the lackluster IT job market performance in February. It said in its report today that hiring of IT Pros is hindered by the lack of qualified individuals and a slowing economic picture, which “will have a dampening impact on the growth of the IT job market size.

According to Janco’s data, there are currently 4.18 million US workers employed as IT professionals. The rate of growth in the number of new IT jobs has slowed, the firm said.

“There now are just over 121,000 unemployed IT professionals. The IT job market shrank by over 48,600 jobs in calendar year 2023, Janco’s report stated. “Overall that is a flattening of the long term growth rate pattern of IT job market,” the firm said.

One of the more surprising results of the BLS report, however, was that the agency drastically revised its January job gains, which had previously been reported as a leap of 353,000 new jobs. The revised numbers dropped that by more 124,000 jobs.

Tech employers added 185,000 new job postings for positions in February, raising the total number of active tech job postings to more than 436,000, according to CompTIA’s data. California, Texas and Virginia had the largest volumes of tech job postings among the states. At the metro level, Washington, New York, Dallas, Chicago and Boston were the most active markets.

CompTIA

CompTIAOpen positions in artificial intelligence or jobs requiring AI skills continue to hover near the 10% threshold, while positions offering hybrid, remote or work from home options account for about 20% of all tech job postings, CompTIA’s report showed.

Technology companies added an estimated 2,340 workers last month, CompTIA’s analysis of BLS data showed. The technology services and software development sub-sector saw employment increase by 4,200 positions, but those gains were offset by staffing reductions in telecommunications and manufacturing.

Net tech employment spanning tech industry and tech occupation employment totaled more than 9.6 million workers, according to CompTIA’s data.

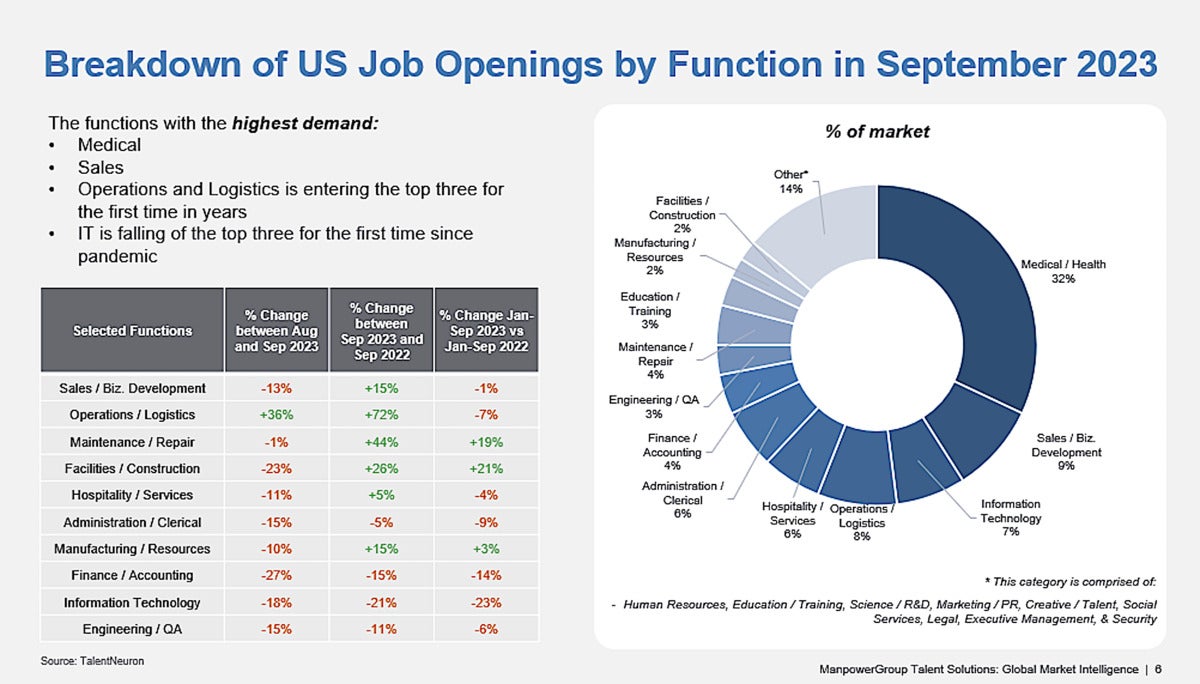

Over the next quarter — from April through June — the US is expected to lead all other nations in IT hiring, according to IT staffing firm Experis, a subsidiary of ManpowerGroup.

Experis

ExperisGer Doyle, head of IT staffing at Experis North America, said while hiring data shows worker demand will remain strong, it will be “more balanced and concentrated.”

Nurses, software developers and front-line retail workers are the three most sought after roles in the U.S. today, according to Doyle.

“In the tech space, AI and machine learning engineers are seeing good growth since last year, with finance and consulting companies as some of the top employers of this specialist tech talent,” Doyle said.

While tech sector layoffs have made headlines over the past year Experis’s data shows the same companies laying people off are also hiring, including top tech companies such as Google, META, Amazon and Apple. However, consuntancies and financial services companies are also hiring – firms such as KPMG, Booz Allen Hamilton, JPMorgan Chase & Co and Slalom Consulting, according to Doyle.

While artificial intelligence and machine learning engineer hiring decreased by 1% in February, the demand for the roles has been trending upward since May 2023, Doyle said.

Wages are following suit, and have remained steady overall, with month-over-month increases in some sectors where remote and hybrid roles have increased, such as IT and business operations.

Hybrid job roles are strongest in the IT (38%) and finance (40%) sectors, according to Experis data.

January 2024

The US added twice as many jobs in January as analysts had expected, though the unemployment rate remained unchanged at 3.7% and tech layoffs continued to plague the IT industry.

In January, the US added 353,000 jobs, according to data published today by the US Bureau of Labor Statistics (BLS). And for tech workers, the latest employment data suggests 2024 is off to a promising start, according to an analysis by IT trade association CompTIA.

Tech companies added nearly 18,000 workers last month, the second consecutive month of job growth. The unemployment rate for tech occupations remained at 3.3%, well below the overall national rate, according to CompTIA. Yet, overall, tech occupations, which span all industries, were down in January.

Tech companies added jobs in several primary sub-sectors:

- Technology services and software development (+14,500)

- Cloud infrastructure (+2,100)

- Tech manufacturing (most notably semiconductors) (+1,400)

Also, on the rise – job openings in artificial intelligence (AI) and positions that offer hybrid, remote, or work from home options. AI job postings or jobs requiring AI skills increased by about 2,000 positions from December to 17,479 last month, CompTIA said.

Tech occupations across all markets and the broader economy, however, declined by an estimated 117,000 positions. “This month’s data is a helpful reminder of the many moving parts in assessing tech workforce gains or losses,” said Tim Herbert, chief research officer at CompTIA. “The expansive tech workforce will simultaneously experience gains and losses reflecting employer short-term and longer-term staffing needs.”

CompTIA

CompTIAEmployers listed more than 392,000 active tech job postings, with nearly 178,000 added last month alone. January’s total of active postings was 33,727 more than the December 2023 figure, the largest month-to-month increase in a year.

There was significant employer interest in filling positions in software development, IT project management, data analysis and science, IT support and systems analysis and engineering. And after several months of decline, the number of job postings offering hybrid, remote or work-from-home options exceeded 30,000 in January, up about 5,000 from December.

“Looking at the bigger picture, we continue to see a post-pandemic rebalancing,” said Becky Frankiewicz, president of staffing firm ManpowerGroup NA. “While hiring isn’t as strong as a year ago, it is better than pre-pandemic and has improved month-over-month.

“We’re also seeing an expected post-holiday hangover in retail and logistics, balanced by increases in IT, finance, accounting and engineering,” she continued. “Overall, more jobs are available now for each unemployed worker than there were before the pandemic, creating a stable environment for employers and employees.”

Foote Partners

Foote PartnersLayoffs in the tech sector have been a thorn in the side of an otherwise healthy industry. Amazon, Google, and Microsoft collectively laid off tens of thousands of workers last year and were among a number of companies that announced planned layoffs for this year. Meta and Google and AWS are cutting back on more ambitious “moonshot” projects, as enterprises are still hesitant to spend big on large software buildouts, etc.

This week, iRobot announced it would lay off about 31% of its 1,250 employees after a deal to be acquired by Amazon fell through.

Layoffs.fyi

Layoffs.fyiThe number of employees laid off at tech companies more than tripled between December and January, according to industry tracker Layoff.fyi. So far this year, 115 tech firms have laid off 30,375 employees, according to the site.

Though layoffs remain below pre-pandemic levels, the number of US employees filing for jobless benefits last week reached an 11-week high. And while the stock market continues to soar, tech companies appear worried.

Many segments of the market remain soft, according to Jack Gold, principal analyst with business consultancy J. Gold Associates. That is likely to continue for at least the next two quarters, he said.

“Tech layoffs might make the headlines, but our real-time data shows a more nuanced story. In many cases, the same companies that are laying people off are also still hiring — they’re just laser focused on hiring to meet demand,” said Ger Doyle, senior vice president of tech employment service Experis.

As an example, Microsoft and Amazon, which recently cut jobs in gaming and streaming, respectively, are simultaneously planning huge investments in AI, according to Doyle.

Experis’s data shows tech demand rebounded in January (up 26% compared to December), with demand for AI/ML engineers growing 19% last month.

Layoffs.fyi

Layoffs.fyi“AI hiring is through the roof due to betting on the future next big thing,” Gold said. “But that leaves many more mature industries vulnerable to scaling back. The thinking in many companies is, let’s cut back on ‘fringe’ stuff until we can determine if we’re going to be OK.”

Doyle said it’s important for employess to keep a focus on internal mobility. “We’re also seeing small and mid-size companies have their moment, scooping up tech talent that may have let go by the big hitters. It’s also important to remember that today every company is a tech company — Capital One, Doordash and Reddit are among the top hirers of AI and machine learning talent in the country today.

“Those with tech skills will still find themselves in high demand and able to call the shots on remote working, too…,” Doyle said.

December 2023

Unemployment in the IT industry ticked up from 2% in November to 2.3% in December, according to an analysis of the latest jobs data from the US Bureau of Labor Statistics (BLS).

Tech occupations throughout the US economy declined by 79,000 positions last month, though the unemployment rate for tech occupations was still well below the overall national unemployment rate of 3.7%.

The up-and-down pattern in tech employment seen over the past few months continued in December, according to CompTIA, an IT trade association.

Tech companies added the largest number of workers since April, but tech occupations throughout the economy declined, according to CompTIA’s analysis of data from the BLS.

CompTIA

CompTIAJob postings for tech occupations also fell. Active postings totaled nearly 364,000, including 142,295 newly added by employers in December, according to CompTIA.

There’s still strong demand for tech workers; US employers advertised 3.13 million IT job postings during 2023 for a wide range of positions including support, infrastructure, software, data, cybersecurity, and technology enablement.

In December, the top tech job postings by job openings in the US were:

- Software Developers and Engineers — 40,490;

- IT Project Management, Data Analysts, Emerging, Other — 27,853;

- IT Support Specialists — 16,526;

- Systems Analysts and Engineers — 12,513;

- Data Scientists — 10,293.

(Not every “help wanted” ad results in a new hire; generally, the ratio is one new hire for every eight job postings, according to CompTIA.)

One area that saw marked hiring involved artificial intelligence (AI) roles. Employer hiring for AI and other specialized skills continued to exceed 10% of all tech job postings, CompTIA said.

The push for AI and generative AI hires might be having an adverse effect on entry-level IT positions, especially in customer service, telecommunications, and hosting automation, according to Victor Janulaitis, CEO of IT consultancy Janco Associates, Inc.

“CIOs and CFOs are looking to improve the productivity of IT by automating processes and reporting where possible,” Janulaitis said. “They are focusing on eliminating ‘non-essential’ managers, staff, and services. Experienced coders and developers still have opportunities.”

The highest demand continues to be for AI specialists, security professionals, programmers, and blockchain processing experts, according to Janulaitis.

Ger Doyle, senior vice president of IT staffing firm Experis, said he still sees “very strong demand” for full stack developers, data scientists, and AI experts. “Seventy-six percent of IT employers say they are facing difficulty finding the talent they need,” Doyle said.

Experis

Experis“Supporting people to gain experience and develop new skills will be key to alleviating talent shortages and helping people build employability for the long term,” IT staffing firm ManpowerGroup said in a statement.

Overall, US employers anticipate measured hiring in the first quarter of 2024, while persistent talent shortages continue to impede hiring, according to the latest Employment Outlook Survey from staffing firm ManpowerGroup. With seasonal variations removed from the data, the Net Employment Outlook (NEO) for the U.S. is +35%.

(The NEO is derived by taking the percentage of employers anticipating an increase in hiring activity and subtracting the percentage of employers who expect a decrease in employment at their location in the next quarter.)

Globally, the US ties for second place in the world (+35%), outpaced by first-place ties, India and The Netherlands (+37%).

“Tech employment remains on solid footing,” Tim Herbert, chief research officer at CompTIA, said in a statement. “Despite the ongoing pattern of mixed signals in the labor market tracking data, the optimistic outlook continues to hold.”

Janulaitis saw it differently, however: “Layoffs at big tech companies continued to hurt overall IT hiring in 2023. CIOs are looking at a troubling economic climate and are evaluating the need for increased headcounts based on the technological requirements of their specific business operations. At the same time, with a mean total compensation of $100,000 for ITpPros, IT will continue to be a target for budget cutting.”

Talent mobility is set to be the key trend of the new year — employers need to look for potential vs past performance and help people make lateral moves within their organization, according to ManpowerGroup.

In December, overall US employment rose by 216,000 people, according to the BLS . The overall unemployment rate remained unchanged from the previous month, with the number of unemployed workers was essentially unchanged at 6.3 million.

Employment in professional, scientific, and technical services continued to trend up, adding 25,000 jobs; the industry added an average of 22,000 jobs per month in 2023, about half the average monthly gain of 41,000 in 2022, according to the BLS report.

For all of 2023, the US added 2.7 million jobs. While the overall unemployment rate has remained under 4% over the past two years, last year ended with a higher unemployment rate (3.7%) than in 2022 (3.5%). Employment continued to trend up in government, healthcare, social assistance, and construction, while transportation and warehousing lost jobs.

“The 2024 labor market is all about balance and moderation — restoring equilibrium after four years of pandemic related swings,” said Becky Frankiewicz, president of the North America Region for staffing firm ManpowerGroup. “Today’s report…shows continued stabilization and an optimistic start to the New Year for employers and workers. Employers are holding onto their people and hiring where the demand exists.”

Average hourly wage growth accelerated slightly in December, rising by 4.1% over the previous 12 months to $34.27 an hour and continued to beat inflation, boosting workers’ spending power, according to BLS data.

November 2023

The number of new IT jobs being added to the US economy has continued to shrink over the past three months, even as the unemployment rate for tech workers has remained near historical lows.

The unemployment rate for tech workers dropped from 2.2% in October to about 2% in November, according to new data based on US Bureau of Labor Statistics.

Overall, US employment increased by 199,000 in November, and the national unemployment rate edged down to 3.7%, according to the US Bureau of Labor Statistics. That tracks with October, when employment increased by about 150,000 jobs and the unemployment rate was 3.9%.

While there have been a plethora of big employers announcing tech layoffs, there has also been a redistribution of tech talent to midsize and small companies that “finally got their shot at hiring talent post-pandemic,” according to Becky Frankiewicz, president of ManpowerGroup, North America.

“This talent was scooped up almost in real time by smaller size businesses, so it remains quite difficult to fill tech roles in the country,” Frankiewicz said. “Now that every company is a tech company, we also saw tech talent absorbed into other sectors outside of tech — like retail and hospitality.

“We continue to see strong demand in business analyst roles and software developers as companies continue to work on readying projects for the new year and building out their apps for more clicks this season,” she added.

According to a report from business consultancy Janco Associates, the IT job market shrank by 12,000 open positions in the last three months, leaving 101,000 unemployed IT professionals. At the same time, close to the same number of tech positions remain unfilled.

“CIOs have started to halt hiring IT pros. Demand for contractors and consultants is slow due to economic uncertainty,” Janco CEO Victor Janulaitis said in the report. “On a bright side, there are still over 120K unfilled jobs for IT professionals.”

Year to date, the IT job market has shrunk by 24,900 positions, according to Janco’s report. Currently, about 4.18 million people are employed as IT professionals in the US, according to Janco.

Janco Associates

Janco AssociatesJanco’s figures show a year-to-date loss of nearly 25,000 IT jobs.

In the past 18 months, the number of IT pros hired each month has moved from 105,00 to 57,000 in October 2023.

“2023 was not a good year for the size of the IT job market,” Janulaitis said. “We currently do not see any change in that trend. In our professional opinion, in 2024 the size of the IT job market will remain at about the same levels as the fourth quarter of 2023, with growth in size limited to minimal levels.”

The number of unfilled positions for IT pros has fallen from 148,000 to 101,000 in the past 18 months. “There still is demand; however, not at the peak of the post-pandemic hiring frenzy,” Janulaitis said.

Not all IT job reports were doom and gloom, however. CompTIA, a nonprofit association for the IT industry and its workers, echoed ManpowerGroup’s findings, saying that hiring among SMBs is up — way up. And employer demand for AI talent boosted the share of job postings to 12%, the company stated.

Meanwhile, CompTIA’s numbers showed tech unemployment to be at 1.7%, well below ManpowerGroup’s figures, even as it estimated that tech occupations throughout the economy declined by 210,000 last month.

Tech occupations across the economy increased by an estimated 483,000 jobs, according to CompTIA. Tech firms added an estimated 2,159 workers, mainly in IT services and custom software development, CompTIA’s Tech Jobs Report showed.

“With the gains in employer hiring intent for AI talent, the job posting data is finally catching up to the hype,” said Tim Herbert, CompTIA’s chief research officer. “As an enabling technology, companies hiring for AI skills inevitably need to boost adjacencies in areas such as data infrastructure, cybersecurity, and business process automation.”

Employer hiring activity as measured by job postings for tech positions totaled 155,621 for November. Jobs associated with artificial intelligence (AI) made up 12% of the total, more than 18,000 postings. It’s the first time AI positions have surpassed the 10% threshold. Positions in emerging technologies or jobs that require emerging tech skills accounted for 26% of tech job postings last month.

CompTIA

CompTIATech job postings continue to fall. (Click image to enlarge it.)

ManpowerGroup’s Frankiewicz said her company’s analysts anticipated a stabilization of the IT job market with real-time data showing impacts to all sectors, including “always-hot healthcare” and retail.

“In real time, we’re seeing double-digit declines in job postings month over month and year over year that we haven’t seen since 2020. This moderation is welcome for many employers — who are finding it easier to fill vacancies,” Frankiewicz said.

“Time to fill roles has dropped to 49 days in November, from an average of 122 days in 2023 to date. For highly skilled roles like software developer, the time to fill has dropped by more than half, from 106 days to 29,” she added.

“We’re also seeing signs of the heavy hitter big companies taking a back seat and midsize employers with 50-249 employees having their moment — a trend that began with tech talent and is now impacting across the board,” Frankiewicz said.

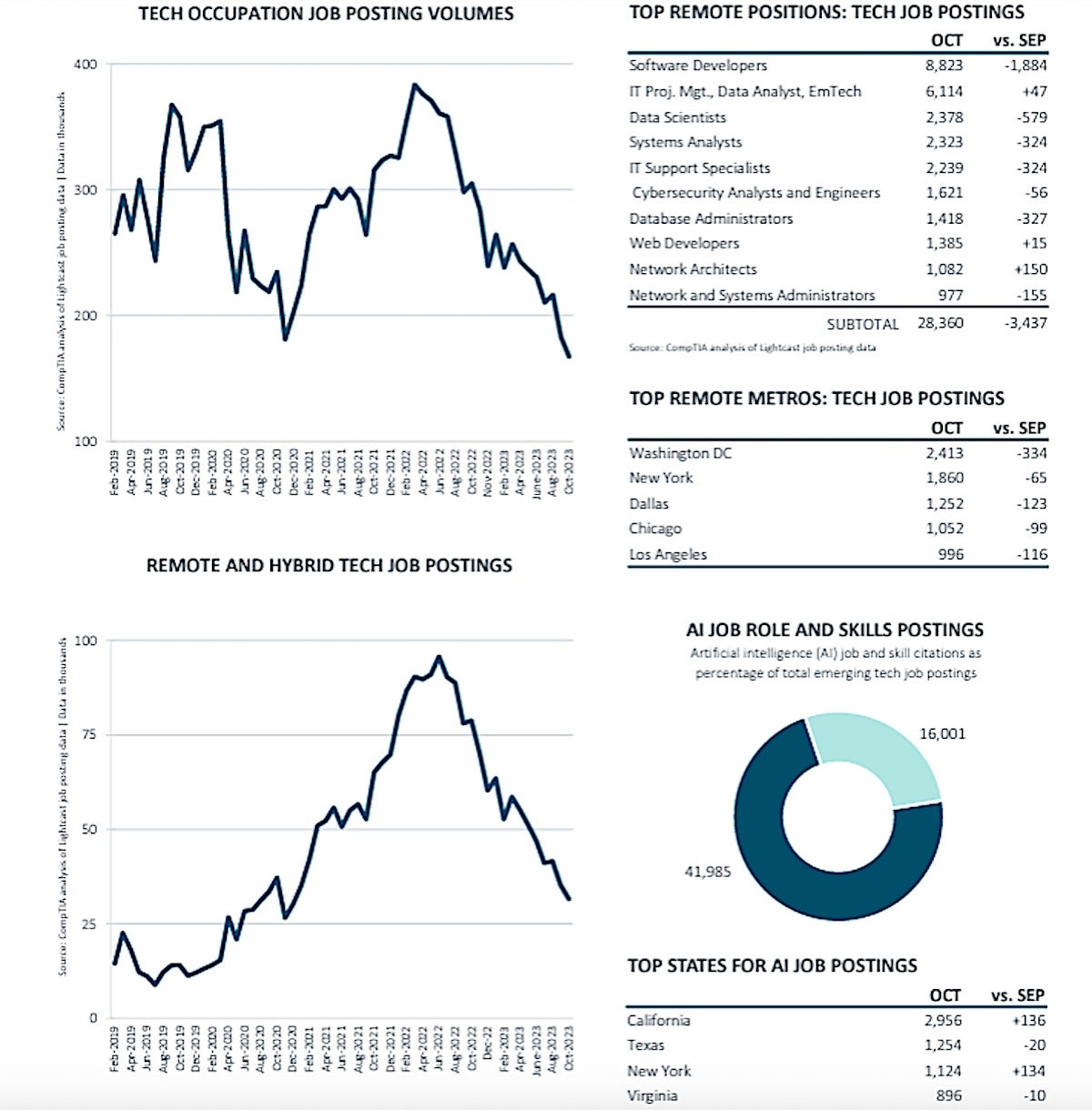

October 2023

The national job rate for technology workers remained little changed in October, according to an analysis of data from the US Bureau of Labor Statistics (BLS).

The unemployment rate for tech workers in October dropped from 2.2% in September to 2.1% last month, even as there has been a cooling in the broader US job market. Technology companies and employers throughout the economy added workers to their payrolls in October, according to CompTIA, a nonprofit association for the IT industry and its workers.

Tech occupations across the economy increased by an estimated 483,000 jobs, according to CompTIA. Tech firms added an estimated 2,159 workers, mainly in IT services and custom software development, CompTIA’s Tech Jobs Report showed.

CompTIA

CompTIAIt was the second consecutive month of job growth in the sector — albeit at a modest pace.

“It’s fair to say tech employment gains for the month exceeded expectations, given the recent labor market swings,” Tim Herbert, chief research officer at CompTIA, said in a statement. “Companies continue to focus on the technologies and skills that deliver meaningful business value.”

California, Texas, Virginia, Florida and New York had the highest volumes of tech job postings among the states, CompTIA indicated. The Charlotte, Boston, San Diego, Cleveland and Phoenix markets were also active in October, with month-over-month increases in employer postings for tech jobs.

While the US market added 150,000 jobs in October, the overall unemployment rate rose from 3.8% to 3.9%, according to the US Bureau of Labor Statistics. The number of unemployed persons — 6.5 million — changed little in October. However, since their recent lows in April, those numbers are up by 0.5% and 849,000, respectively.

The uptick in unemployment and the slower pace of hiring pointed to a cooling of the employment market. In September, for example, 279,000 jobs were added to the US economy.

Janco Associates

Janco AssociatesBecky Frankiewicz, president of staffing firm ManpowerGroup’s North America region, credited the slowdown for employees being less likely to leave for new roles than they were at the height of the pandemic. Hiring, she said, is solid but settling down.

“Our real-time data shows that in many sectors, especially blue-collar and tech, the market is finding balance,” she said. “The post-pandemic hiring frenzy and summer hiring warmth has cooled and companies are now holding onto employees.”

The tech sector is also cooling from its torrid growth over the past two or more years, but there’s still demand for highly skilled positions including app developers, cyber security experts and data analysts, Frankiewicz said.

“The most in-demand functions remain steady — with most new roles posted in medical and healthcare, sales and IT,” she said.

After a spike in the number of openings for IT professionals in the early summer, the number of unfilled openings for IT professionals fell from 201,000 in August to 160,000 in September. That reflects a pullback from the peak of 254,000 opening in July, according to Frankiewicz.

CompTIA

CompTIAAbout 20% of job postings offered work from home or remote work as an option, according to CompTIA. One-quarter were for positions in emerging technologies or jobs that require emerging tech skills, including 16,000 associated with artificial intelligence (AI) jobs and skills. Employer hiring for AI positions and skills continues to trend upward, although it’s still a relatively small share of overall tech hiring activity.

Along with AI-skilled workers, software developers, IT support specialists, systems analysts, and data scientists are among the job roles in greatest demand, according to CompTIA.

Victor Janulaitis, CEO of Utah-based research firm Janco Associates, agreed AI and machine learning skills are in demand, though the number of coder openings is falling. At the same time, hiring of IT professionals is hindered by the lack of qualified individuals and a slowing economic picture.

“This will have a dampening impact on the growth of the IT Job Market size,” Janco stated in its latest tech market jobs report.

September 2023

The US unemployment rate remained at 3.8% in September, but the market added 336,000 jobs, far surpassing analyst expectations, according to today’s Bureau of Labor Statistics numbers.

Tech employment, however, was a laggard in the generally upbeat US employment report released today, according to analysis by the nonprofit trade association CompTIA. Key metrics of tech hiring activity all slipped in September, its report showed.

Tech jobs among all sectors across the economy fell by an estimated 20,000. The technology sector unemployment rate ticked up from 2.1% in August to 2.2% in September, but it remains well below the national rate of 3.8%, according to CompTIA.

Tech salaries also appeared to be on a downslope, according to an analysis by job matching site Hired, which notes that US inflation-adjusted salaries have plummeted to a five-year low.

Meanwhile, tech sector companies reduced staffing by a net 2,632 positions last month, according to CompTIA’s analysis of BLS data.

Employer job postings for future tech hiring also fell to 184,077 in September, down from nearly 208,000 in August. (Future tech hiring is defined by CompTIA as expected open requisitions.)

“Demand for software positions continues to drive the largest volume of hiring activity. In the aggregate, volumes are equally large in positions spanning IT project management, IT support, data analytics, and systems/cloud infrastructure,” CompTIA’s report stated.

CompTIA

CompTIAPositions in emerging technologies or jobs requiring emerging tech skills accounted for 26.5% of all tech jobs postings last month, up from 22% in August. Within emerging tech job postings, 36% were associated with artificial intelligence (AI).

“There is no sugar-coating the off month of tech employment data,” Tim Herbert, CompTIA’s chief research officer, said in a statement. “Despite the persistently high demand for tech skills on many fronts and positive forward-looking projections, there is a lag in hiring at the moment.”

CompTIA

CompTIAJim McCoy, senior vice president of staffing firm ManpowerGroup, echoed Hebert’s sentiments on tech employment, but he said one bright sector has been smaller firms that are still dealing with a skills gap.

“To be sure, large companies have pulled back hiring and even cut workers, especially in technology, as borrowing costs have spiraled higher,” McCoy said. “But many small and midsized businesses that struggled to attract workers are snapping up those laid off and drawing from a more plentiful labor supply as Americans sidelined by COVID return to the workforce.”

The BLS jobs report showed the average hourly earnings for all employees rose by 7 cents, or 0.2%, to $33.88. Over the past 12 months, average hourly earnings have increased by 4.2%, the report stated. In September, average hourly earnings of private-sector production and nonsupervisory employees rose by 6 cents, or 0.2%, to $29.06.

While hiring may be up overall, real wages in the technology sector appeared to be declining, according to a recent report from job matching site Hired.

In its annual State of Tech Salaries Report, released in late September, Hired said the tech talent market has seen dramatic shifts from 2022 to the first half of 2023, fueling tension and misalignment between recruiter and job candidate expectations.

Following a year of record-breaking inflation and market turbulence, local salaries in the US, including those for fully in-person or hybrid roles, have experienced their most significant year-over-year decline, dropping by 3% from $161,000 to $156,000. In contrast, salaries in the UK have seen a 4% increase, rising from £82,000 to £86,000, according to Hired.

Hired

HiredWhen adjusted for inflation, local salaries decreased 9% from $141K in 2022 to $129K by mid-2023, while remote salaries decreased 6% from $143K in 2022 to $134K by mid-2023.

Amid the rise of generative AI and a tightening of corporate budgets, junior talent (workers with less than four years of experience) have experienced the most significant decrease in salaries — nearly 5% year-over-year — and demand, with posted roles on the platform lowering from 45% in 2019 to 25% in the first half of 2023, according to Hired’s report.

“Compared to last year, we are witnessing a seismic shift in tech employee and employer preferences. The surging demand for experienced tech talent on our platform and employers’ increasing reliance on AI tools point to an ever-growing skills gap. This challenge will only heighten as companies reduce their hiring locations amid their return to the office and limit their access to qualified talent,” said Josh Brenner, CEO at Hired.

“With the future talent pipeline at risk of a deficit, companies cannot afford to disregard high-quality talent at any level. Instead, they must embrace diverse candidates with transferable skills who can adeptly address industry challenges, especially amid rapid advancements driven by emerging technologies like AI,” Brenner added.

Hired

HiredThe highest paid tech workers were engineering managers, particularly with the introduction of AI tools and increased cybersecurity challenges. Engineering managers earn on average $202,000 in the US and £118,000 in the UK — a notable 10% increase from £107,000 at the end of 2022.

Specialized engineers are the most in demand in 2023: Employers on Hired’s marketplace have a higher demand for specialized engineers, especially for AI applications such as ML, as well as cybersecurity, data, and back-end engineers.

AI isn’t an immediate threat to job security, but it could present challenges for job seekers in the coming years: While the majority of surveyed candidates (87%) currently do not view AI as the primary threat to their roles, a significant portion of employers (47%) project they will leverage AI to reduce headcounts by 2029.

Overall, there were job gains in leisure and hospitality, government, healthcare, professional services, scientific and technical services, and social assistance.

Employment in professional, scientific, and technical services increased by 29,000 jobs in September, in line with the average monthly gain of 27,000 over the prior 12 months, BLS data showed.

Victor Janulaitis, CEO of Janco Associates, identified the 10 AI skills listed most often on client open job requisitions for IT professionals. The one AI skill that was included in more than 60% of those requisitions: ChatGPT.

“Since its launch in November of 2022, ChatGPT has been implemented by the greatest number of organizations,” Janulaitis said in a blog post. “As a result, companies are recruiting IT professionals who have the skills to help them with using ChatGPT for content generation, task automation and scripting… and more.”

Other skills listed in open IT job requisitions: Natural Language Processing, TensorFlow, Image Processing, PyTorch, Generative AI content creation, Midjourney, AI Chatbot, Model Tuning, and Stable Diffusion.

PricewaterhouseCooper’s Global Workforce Hopes and Fears Survey found sizeable pockets of the global workforce eager to learn new skills, embrace artificial intelligence (AI), and tackle new challenges — even as many companies fail to tolerate debate and dissenting ideas, or even small-scale failures. Meanwhile, many workers are restless: fully 26% say they plan to quit their job in the next 12 months, up from 19% last year.

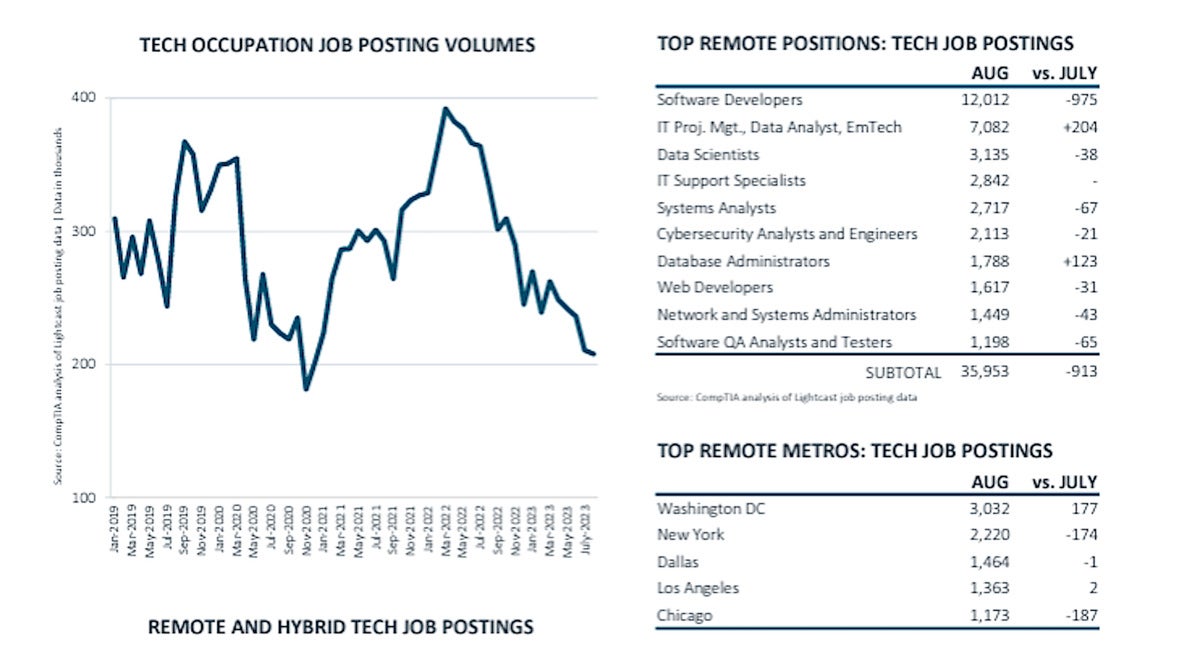

August 2023

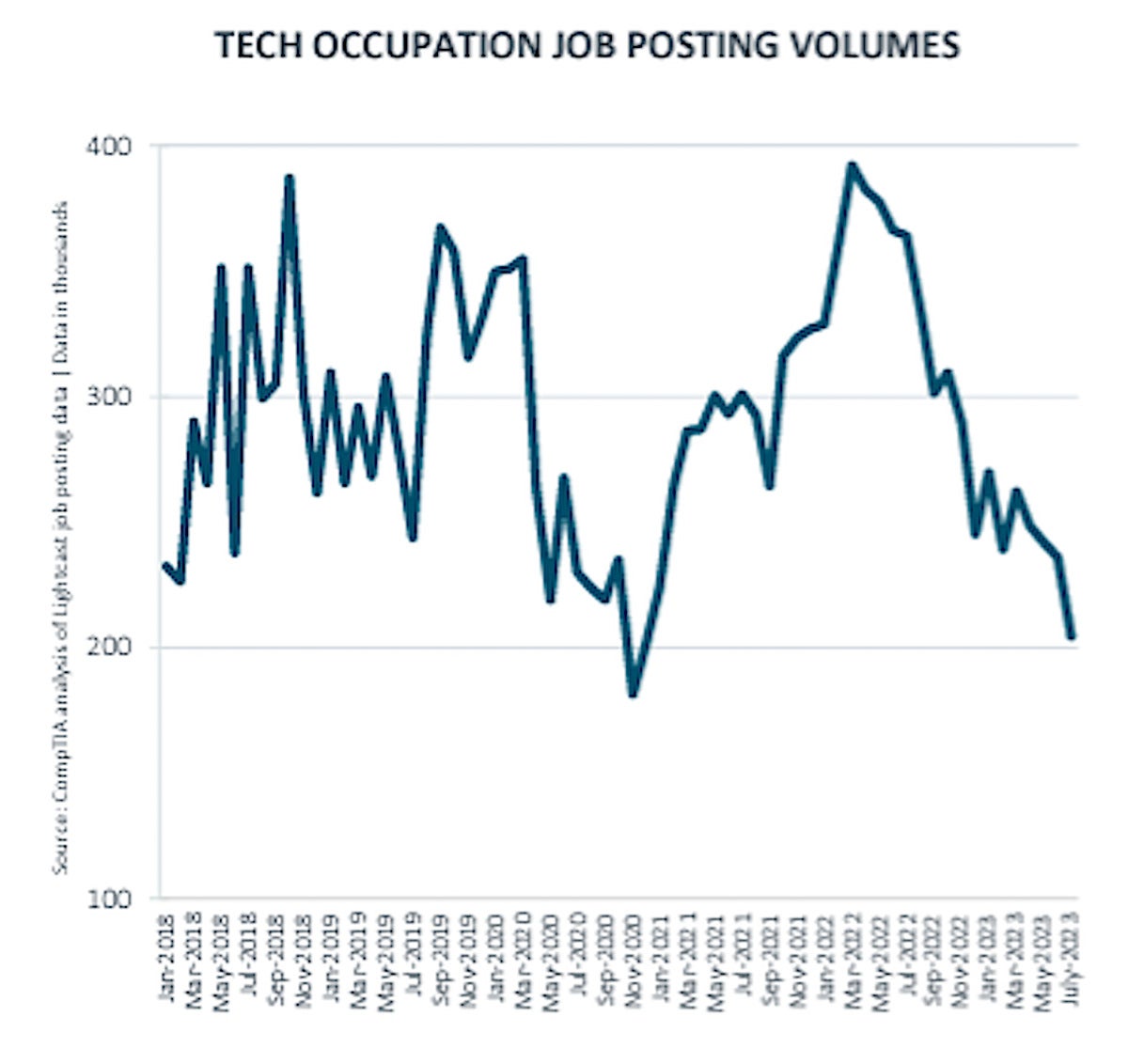

Though they remain low, unemployment figures have seesawed over the past six months, a phenomenon that has some tech industry experts scratching their heads trying to make sense of what may be the new norm.

Last month, unemployment in technology fields increased along with the overall US unemployment rate, which rose from 3.5% in July to 3.8% in August, according to new data from the US Bureau of Labor Statistics (BLS). At the same time, total nonfarm employment across all markets increased by 187,000 jobs in August.

The mixed messages in last Friday’s employment report carried over to the tech industry and workforce, according an analysis by industry group CompTIA.

Tech unemployment had dropped from 2.3% in June to 1.8% in July, as tech firms and employers in other industries added workers after a spate of high-profile layoffs in the tech industry.

CompTIA

CompTIAThe latest BLS report, however, found that employers across the US economy reduced tech occupations by an estimated 189,000 positions, pushing the unemployment rate for tech jobs up to 2.1% — almost where it was in June, CompTIA said.

“The usual caveats of monthly fluctuations in labor market data apply,” said Tim Herbert, chief research officer at CompTIA. “The seesawing between strong and lagging tech jobs reports is undoubtedly confusing, but the overall macro trend of growth in the depth and breadth of the tech workforce remains steady.”

Employer job postings for future tech hiring (a separate category tracked by CompTIA) totaled nearly 208,000 in August, a slight decline of 1.4% from the previous month. But job postings for information security analysts increased 19% from July to August to more than 12,000 postings. Other in-demand occupations include software developers, tech support specialists, computer systems analysts, and data scientists.

“With ‘pandemic paranoia’ about hiring lingering, companies are continuing to hold onto their workers, remembering how hard it was to rehire,” said Becky Frankiewicz, president of global staffing firm ManpowerGroup’s North America Region. “Essential workers we valued through the pandemic may not be feeling so essential, as real-time job postings for blue collar roles like operations and logistics/maintenance and repair are down 43% month over month” based on ManpowerGroup’s real-time data.

ManpowerGroup

ManpowerGroup“This Labor Day is a great occasion to celebrate the resilience of the American worker,” she said. “Although we are seeing a slowdown, the labor market remains healthy, and we are optimistic about the future.”

Positions in emerging technologies or jobs requiring emerging tech skills, such as artificial intelligence (AI) and data science, accounted for 23% of all tech jobs postings in August. Among emerging tech job postings, 37% were associated with AI, with California, Texas, New York, Massachusetts, and Virginia showing the highest numbers of AI-related job postings.

Experis

ExperisNew data from IT staffing firm Experis found that an increasing number of companies surveyed are either adopting or planning to adopt emerging technologies in their recruiting processes. That comes as more than three quarters (78%) of IT organizations report difficulty finding talent with the right skills — a 17-year high.

According to Experis, 58% of employers believe AI and virtual reality will create jobs, not kill them. Additionally, cybersecurity, technical support, and customer experience remain high-priority IT staffing areas. Half of employers say they are training and upskilling their current workforce to address staffing challenges.

ManpowerGroup

ManpowerGroup“The integration of AI, machine learning, VR/AR, and other emerging technologies is rapidly transforming industries and driving the need for an adaptable workforce,” said Experis Senior Vice President Ger Doyle. “We are seeing companies embrace these new technologies with many seeking to hire or upskill existing talent to take advantage of potential productivity gains. Smart employers know that embracing digitization and nurturing human talent will enhance their readiness to succeed in this era of rapid technological advancement.”

ManpowerGroup

ManpowerGroupJuly 2023

The unemployment rate for tech jobs dropped from 2.3% to 1.8% in July, as technology companies and employers in other industry sectors added workers, according to analysis of US Bureau of Labor Statistics (BLS) data.

It was the lowest tech-sector unemployment rate since January, according to CompTIA, a nonprofit association for the IT industry and workforce.

The overall US unemployment rate also dropped slightly last month from 3.6% in June to 3.5%, according to BLS data. About 187,000 non-farm jobs were added, less than the average monthly gain of 312,000 over the prior 12 months. In July, jobs grew in healthcare, social assistance, financial activities, and wholesale trade, according to the BLS.

CompTiA

CompTiAThe overall unemployment rate has ranged from 3.4% to 3.7% since March 2022.

According to BLS data, employment in professional, scientific, and technical services continued to trend up in July with 24,000 positions filled.

Tech sector companies increased their staffing by 5,432 employees, according to CompTIA’s analysis of BLS data. Leading the way in new IT hires were custom software services and systems design;and PC, semiconductor and components manufacturing.

Janco Associates

Janco AssociatesIT salaries were on the rise, too, according to a mid-year analysis by business consultancy Janco Associates, as more companies invested in IT. The emphasis in recent years has been on both e-commerce and mobile computing. And with growing numbers of cyberattacks and data breaches, CIOs are looking to harden their sites and lock down data access to protect all of their electronic assets, according to Janco Associates.

The lone drag on the July data was in employer job postings for tech occupations, which slipped to from 236,000 in June to 204,400 for the month of July.

“Given the pace of tech hiring, it remains a fairly tight market for tech talent,” Tim Herbert, chief research officer for CompTIA, said in a statement. “It continues to be an environment where employers must supplement recruiting efforts with proactive talent development strategies.”

While the drop in tech sector unemployment is notable, it’s not uncommon for rates to fluctuate, according to Herbert. Over the past 5.5 years dating back t0 January 2018, the tech unemployment rate saw a 1/2-point or higher rise or fall from the previous month 27 times, which translates to 40% of the time, he said in an email to Computerworld.

In comparison, the national unemployment saw the same kind of variation 22 times, or 33% of the time. Herbert said.

“Unfortunately, the Bureau of Labor Statistics does not provide data at a granular enough level to pinpoint the exact tech occupation categories driving changes in the unemployment rate,” Herbert said. “The employer job posting data indicates hiring activity is broad-based spanning all the major job families within tech.”

CompTIA

CompTIAThe way the BLS tracks job seekers also matters; it only keeps tabs on people actively looking for employment, Herbert noted.

“There could be scenarios whereby certain segments of workers go uncounted in the unemployment rate because they put their job search on pause — perhaps to re-evaluate their job search strategy, to pursue additional training, to recharge their batteries, etc.,” he said. “This could have the effect of artificially lowering the unemployment rate.”

There is a difference, however, between the long-term unemployed who might lack skills demanded in the labor market and those who voluntarily put a job search on hold. “My sense is tech workers in this position tend to fall in the latter category given most have in demand skills,” Herbert added.

Janco Associates painted a somewhat gloomier picture of the IT jobs landscape: it said that year to date, IT jobs shrank by 5,500 positions. That’s in contrast to 125,900 jobs created during the same period of 2022.

The number of unfilled jobs for IT pros shrank from more than 200,000 in December to just over 120,000 at the end of July, Janco’s latest report showed. It argued that the growth of the IT job market stopped in January, with a loss of 2,600 positions, with other losses piling up in succeeding months.

“Based on our analysis, the IT job market and opportunities for IT professionals are poor at best,” Janco CEO M. Victor Janulaitis said in a statement.

In the second quarter of 2023, the “big losers” were computer system design jobs (down 10,500); telecommunications (down 5,500); content providers (down 4,700); and other information service providers (down 6,600). Janulaitis said.

Many roles, especially in telecommunications and cloud providers are being automated and eliminated, he said. CIOs and CFOs are looking to improve the productivity of IT by automating processes and reporting where possible and focusing on eliminating “non-essential” managers, staff, and services.

“Experienced coders and developers still have opportunities. The highest demand continues to be for security professionals, programmers, and blockchain processing IT Pros,” Janulaitis said.

As part of an effort to boost return on investment, CIOs are looking to consolidate the cloud service providers they support.

“This will impact the job prospects at those providers,” Janulaitis said. “There continues to be a general belief there will be an economic downturn by many CIOs and CFOs. This is impacting all decisions around hiring new IT pros and increasing technology-related expenditures. This has impacted the salaries of IT pros with a major impact on the compensation of IT executives.”

Meanwhile, according to CompTIA, the strongest demand was for software developers and engineers, IT project managers, data analysts, IT support specialists and emerging technologies. Positions in emerging technologies or jobs that require emerging tech skills accounted for about 23% of all tech job postings in July.

Within the emerging tech category, 35% of job postings referenced artificial intelligence (AI) work and skills, CompTIA said.

June 2023

IT workers are well positioned to not only keep their jobs but to get big bumps in pay when looking for new opportunities, according to analysis of jobs data released today by the US Bureau of Labor Statistics (BLS).

Overall, the US unemployment rate dropped slightly from 3.7% in May to 3.6% in June, with about 206,000 jobs added, according to the BLS. The number of jobs added last month was down 100,000 from May.

Wages also increased as employers continued to struggle to find workers. Average hourly earnings of private-sector production and nonsupervisory employees grew 4.4% in June over the same period last year to $28.83, according to the BLS.

Tech sector companies increased headcount by 5,348 jobs last month, according to an analysis of BLS data by industry group CompTIA. Among the six top tech occupation categories, three have shown positive gains through the first half of 2023: IT and custom software services and systems design; PC, semiconductor and components manufacturing; and cloud infrastructure, data processing and hosting.

Overall, however, tech occupations throughout the economy declined by an estimated 171,000, according to CompTIA. The unemployment rate for tech jobs edged up from 2% to 2.3%, still well below the national unemployment figure.

CompTIA

CompTIASoftware developers were in particularly in high demand, according to CompTIA. Job openings had dropped by more than 2,700 positions in May, but in June software development positions rose by more than 15,700 openings. Job openings for IT project managers and data scientists also lept in June, up by 8,633 and 3,929, respectively.

Other IT positions that saw marked increases included system analysts, IT support specialists, web developers, cybersecurity analysts and engineers, and database adminitrators, according to CompTIA.

Overall, tech-related employment mirrored June’s overall easing of the labor market nationally, CompTIA said. Tech occupations throughout the economy fell back and job postings for future hiring were down modestly, with jobs offering remote/hybrid work arrangements falling off even as opportunities to work with artificial intelligence rose in the emerging job market.

“The latest tech employment figures do lag some, but the underlying fundamentals remain unchanged. All signs point to a continuation of the growth trajectory for the tech workforce,” Tim Herbert, chief research officer, CompTIA, said in a statement.

CompTIA

CompTIAAhead of the BLS jobs report, HR software provider ADP released its own jobs report Thursday saying private sector jobs surged by 497,000 in June, well ahead of the 267,000 gain in May and much higher than the 220,000 analysts had estimated.

“According to the Department of Labor, [ADP’s] numbers were way off,” said Jamie Kohn, senior director of human resources research at Gartner. “I do think we’re seeing a slight slowdown in jobs at the moment, but there’s such a shortage of talent, companies are trying to keep up.”

Employment rates for prime age workers — 18- to 54-year-olds — is back to pre-Covid numbers and companies are reticent to make further cuts even as economists continue to chirp about a possible recession.

“We have data that shows on median, people are getting a 15% increase when they move from one job to another,” Kohn said. “They’re actually getting higher pay bumps than they thought they would.” On average, most job seekers expect an 8% increase in pay in a new job, according to a new Gartner survey.

Another trend putting pressure on the job market is an increasing number of Baby Boomer retirements, leaving management positions and other senior jobs unfilled.

“We’re about half way through Baby Boomer [generation] retirement. The market is likely to get tighter as the latter half of the Baby Boomer generation retires over the next decade or so. Some people also retired early during and coming out of the pandemic,” Kohn said. “I’m hearing from a lot of HR leaders who are trying to figure out how to convince people to delay retirement because they’re finding it hard to find people.”

IT workers in particular are in demand, Kohn said. The Gartner survey showed 78% of job market candidates have multiple offers on the table. That compares to overall job seekers, 72% of whom had multiple job offers.

CompTIA

CompTIAWhile organizations across all US industries are expected to boost hiring in the third quarter, employers in the IT market have the most aggressive hiring plans, according to global staffing firm ManpowerGroup.

Unmet demand for talent is highest in IT-related fields, with 78% of employers in IT reporting challenges in hiring, according to an earlier report from ManpowerGroup. This suggests that tech workers who find themselves laid off will soon be reabsorbed into the market.

ManpowerGroup’s real-time data is showing plentiful opportunities in logistics, job openings grew 25% this quarter, sales and business development were up 10%, medical (up 9%) and finance (up 8%).

“We’re seeing the relationship between employers and workers continue to evolve, particularly for workers with in-demand skills,” Becky Frankiewicz, ManpowerGroup’s regional president and chief commercial officer, said. “As ‘pandemic paranoia’ about hiring lingers, companies are holding on to their workers as layoffs calm and permanent roles are more in demand than temporary.”

Hybrid work is also on the uptick, with all industries offering more remote/hybrid roles month-over-month and tech remote work up 34%-40% in June, according to ManpowerGroup. And as the relentless advance of AI continues, employers are betting on people. Companies are investing in the talent and skills they have in house, with organizations re-skilling and up-skilling more than ever.

After some high-profile layoffs by tech companies this year and last, many IT workers are seeking employment in industries they consider more stable, such as financial services, according to Kohn.

Workforce participation by women remains lower than for men. A key reason for that is US employers are not as generous with flexible work, paid maternal leave and childcare assistance as their European counterparts.

“If you have to spend half or more of your income for childcare, no reason to go back to work,” Kohn said, adding that what’s needed is an overhaul of worker benefits rights by the federal government. Another wrinkle: US immigration has seen steep declines — even before the pandemic — further reducing the chance for a glut in job openings.

May 2023

Like April before it, the month of May showed mixed results for tech employment in the US.

Technology companies shed an estimated 4,725 jobs — a figure that includes nontechnical workers — in May, according to an analysis of the latest US Bureau of Labor Statistics (BLS) figures by IT industry group CompTIA. Job postings for open technology positions also eased off, down to about 234,000 from April’s 300,000, according to a new report from CompTIA.

At the same time, however, the number of technology jobs throughout the economy rose by 45,000, according to the report.

Those mixed results for the tech workforce reflect the unpredictability of the overall labor market. US employers added a stronger-than-expected 339,000 jobs in May, but the overall US unemployment rate rose by 0.3 percentage points to hit 3.7%, while the number of unemployed people rose by 440,000 to reach 6.1 million, according to BLS data released today.

Responding to the BLS data, global staffing firm ManpowerGroup also commented on the mixed results for tech pros: “Our data shows cooling in IT, with posted roles down 12% compared to last month. Yet those let go are being quickly reabsorbed, often into midsize companies.”

Indeed, while the national unemployment rate has ranged between 3.4% and 3.7% since March 2022, the unemployment rate for tech occupations has hovered near 2% throughout that time frame. In fact, tech unemployment decreased slightly in May, from 2.1% to 2.0%, according to CompTIA’s analysis of the BLS data.

“Reassuringly, the positives for the month outweigh the negatives, confirming the tech workforce remains on solid footing,” said Tim Herbert, chief research officer at CompTIA.

The most in-demand roles among tech job postings include software developers and engineers; IT project managers, data analysts, and other emerging tech roles; IT support specialists; systems analysts and engineers; and data scientists. Approximately 20% of job postings are in emerging tech fields or require emerging tech skills, including nearly 15,000 postings that mention AI skills, according to CompTIA.

April 2023

Technology companies added 18,795 workers in April, the largest number since August 2022, according to the latest US Bureau of Labor Statistics (BLS) figures and an industry analysis of that information.

The data revealed a mixed bag of results for tech workers last month. Technology jobs throughout the economy declined by 99,000 positions even as employer job postingspassed 300,000 — a level last reached in October, according to a report from CompTIA, a nonprofit association for the IT industry and workforce.

Both the overall US unemployment rate, at 3.4%, and the number of unemployed, at 5.7 million, changed little in April, according to BLS data released today. The national unemployment rate has ranged between 3.4% and 3.7% since March 2022.

The unemployment rate for tech occupations inched up to 2.3% in April from 2.2% in March, still well below the national unemployment rate, according to CompTIA’s evaluation.

“It was another all-too-familiar month of mixed labor market signals,” said Tim Herbert, chief research officer at CompTIA. “The surprisingly strong tech sector employment gains were offset by the pause in tech hiring across the economy.”

CompTIA

CompTIAStill, IT executives and managers are among the most highly paid workers in US corporations, according to a new report based on the latest data from the US Bureau of Labor Statistics (BLS).

A BLS report published last last month — the Occupational Employment and Wages Summary for 2022 — showed computer and information research scientists earn on average about $155,880 a year. Database architects are the second-highest earners with just over $136,540 in annual compensation. Software developers followed at $132,000 a year.

Putting upward pressure on wages has been a combination of scarce tech talent and low unemployement rates.

Computer and IT managers are among the most highly paid positions in the US, earning an average $173,670 across all industries and occupations; that’s even more than the top executives in all industries and occupations ($129,050), according to business consultancy Janco Associate.

In terms of employment in the tech industry, software developers held just over 1.5 million positions in the US, more than double the 700,000 positions held by computer user support specialists. Computer systems analysts, with 500,000 jobs, were in third place, according to Janco’s report.

Late last month, job search website Lensa published a research study showing “computer occupations” are among the most in-demand jobs in the US, second only to “health diagnostic and treatment practitioners.” More than 3.1 million potential applicants clicked on open job positions in the IT arena, according to Lensa.

Overall, the number of workers not in the labor force who currently want a job increased by 346,000 over the month to 5.3 million, according to the BLS. “These individuals were not counted as unemployed because they were not actively looking for work during the four weeks preceding the survey or were unavailable to take a job,” the BLS said.

Both the labor force participation rate, at 62.6%, and the employment-population ratio, at 60.4%, were unchanged in April. These measures remain below their pre-pandemic February 2020 levels, 63.3%and 61.1%, respectively.

Global Staffing firm ManpowerGroup viewed the BLS data from April as a “promise of spring” for the job market, with a higher-than-expected 253,000 jobs added.

Employers continue to hire for in-demand skills while pulling back on non-essential headcount, the company said in a statement to Computerworld. The company also noted some negative trends that emerged with the BLS’s revisions to its March data showing 100,000 fewer jobs, “and the three-month average is tracking down.”

“Today, we’re seeing very concentrated demand with medical, IT, and sales representing 44% of all open positions,” Becky Frankiewicz. president of ManpowerGroup North America said. “That data includes all real-time available jobs across the country. [Job] openings are the lowest they’ve been in two years.”

Employers listed more than 300,000 job postings for tech positions in April, signaling demand for tech talent continues to hold up, according to CompTIA. In March, there were 316,000 tech job openings.

Within the tech sector, three occupation categories paced April hiring, led by IT services and custom software development (+12,700 additional jobs). Job gains were also reported in cloud infrastructure, data processing and hosting (+7,300 additional jobs) and PC, semiconductor and components manufacturing (+3,200 additional jobs).

Employer job postings for tech positions were widely dispersed geographically and by industry. Employers in administrative and support (32,861), finance and insurance (32,820) and manufacturing (31,959) were among the most active last month.

The number of tech job postings that specify remote work or hybrid work arrangements as an option continued to trend upward in April, with more than 65,000 positions across the country; software developers, IT project managers, data analysts and jobs in emerging technologies topped the list

Among metropolitan markets, Washington, DC, New York City, Dallas, Los Angeles, and Chicago had the highest volumes of tech job postings. And Dallas, Houston, Philadelphia, Boston and Seattle saw the largest month-over-month increases in postings, according to CompTIA.

March 2023

Tech sector employment, which includes all workers on the payrolls of tech companies, declined in March by an estimated 839 jobs, according to the US Bureau of Labor Statistics (BLS) and IT industry group CompTIA.

Employer job postings for tech positions for March, however, increased by 76,546 month-over-month, for a total of 316,000 openings; the tech unemployment rate remained unchanged from February at 2.2%.

Technology employment across all industry sectors increased by an estimated 197,000 positions for the month, according to CompTIA’s analysis of BLS data. “This represents the highest level of employer hiring activity as measured by job postings in seven months,” CompTIA said in its Tech Jobs Report.

More than 4.18 million people are now employed as IT professionals in the US, according to industry research firm Janco Associates.

“As a forward-looking indicator, the rebound in employer tech job postings is a notable positive,” said Tim Herbert, CompTIA’s chief research officer. “While caution is in order given the state of uncertainty, the data suggests segments of employers may be stepping back into the tech talent market.”

Overall, the US economy added 236,000 jobs in March, according to the BLS, a slight slowdown compared to recent months; that could mean the jobs market may be responding to recent interest rate hikes by the US Federal Reserve.

At the same time the number of jobs being added to the economy dropped slightly, the overall unemployment rate dipped a tenth of a point to 3.5%, remaining near 50-year historic lows.

CompTIA

CompTIAIT industry advocacy group CompTIA’s March Tech Jobs Report.

The total number of unemployed US workers, at 5.8 million, changed little in March; that measure has shown little net movement since early 2022, according to BLS data.

“The labor market posted solid if not spectacular gains,” Diane Swonk, chief economist and managing director at KPMG LLP, wrote in a blog post. “Hiring in both the public and the private sectors slowed. Hiring by firms with less than 250 workers continues to drive gains in the private sector. Those firms are the most vulnerable to the recent tightening of credit conditions,”

Even as unemployment remains low, there have been a number of high-profile layoffs in the technology industry and elsewhere during the past six or so months; industry experts have said many organizations over-hired during the COVID-19 pandemic and are now having to trim their workforces, a so-called “course correction.”

This year, more than 168,000 workers have been laid off at tech firms, according to industry tracker Layoffs.fyi.

Last month, job search site Indeed fired 15% of its workforce, or about 2,200 employees. The layoffs came from nearly every team and function within the company, CEO Chris Hyams said, and were in response to a job market that has cooled “after the recent post-COVID boom,” he said.

“US total job openings were down 3.5% year-over-year, while sponsored job volumes were down 33%,” Hyams said. “In the US, we are expecting job openings will likely decrease to pre-pandemic levels of about 7.5 million, or even lower over the next two to three years.”

While big tech firms such as Google and Microsoft may be letting workers go, the layoffs aren’t dominated by IT talent. Most of the layoffs are occurring on the business side of the corporate world. In fact, there are fewer IT workers than job openings — a lot fewer.

Positions for software developers and engineers accounted for the largest share of job postings in March, according to CompTIA. Employers are also in the market for IT support specialists, systems engineers and analysts, IT project managers, cybersecurity analysts, and engineers. About one in five tech job postings offer remote or hybrid work arrangements as an option.

A new report from global staffing firm ManpowerGroup found that 77% of employers report difficultly filling job roles, representing a 17-year talent shortage high.

James Neave, head of data science at job search site Adzuna, said despite the latest spate of layoffs, which include Apple and Walmart, job growth has exceeded expectations for 12 consecutive months, “the longest streak since 1998.

“Today’s closely watched jobs report gives another healthy reading on the job market and the strength of hiring,” he said invia email to Computerworld.

On Adzuna, advertised job vacancies in the U.S. totalled 8.3 million in March. As a result, organizations need to continue working to attract and retain highly qualified talent amid shortages and skills gaps, Neave said.

“To win workers, organizations are improving their benefits and providing care for the whole person in such a stressful economic time,” he said. “Boosting benefit offerings also helps to slow staff turnover and reduce the risk of burnout, improving morale as well as the bottom line.”

February 2023

Tech sector employment fell by 11,184 positions in February, a modest reduction of 0.2% of the total tech industry workforce of more than 5.5 million.

Unemployment in the tech sector also jumped from 1.5% in January to 2.2%, in February, according to data released today by the Bureau of Labor Statistics (BLS) and CompTIA, a nonprofit association for the IT industry and workforce.

The unemployment rate for tech occupations is still below the national rate of 3.6%, which saw a .1% increase from January.

The number of technology occupations in all industries declined by .6% or 38,000 positions, according to CompTIA’s report. Tech occupations in the US economy still total more than 6.4 million workers. Among all tech industries, tech manufacturing added a net new 2,800 jobs, the fifth consecutive month of positive gains.

CompTIA

CompTIAEmployer job postings for tech positions also declined by about 40,000, to just over 229,000 in February. Most metropolitan markets experienced fallbacks from January to February, with a few exceptions, according to CompTIA.

“As expected, the lag in labor market data means prior layoffs announcements are now appearing in BLS reporting,” said Tim Herbert, chief research officer for CompTIA. “Context is critical. The recent pullback represents a relatively small fraction of the massive tech workforce. The long-term outlook remains unchanged with demand for tech talent powering employment gains across the economy.”

While there have been hundreds of highly publicized layoffs among tech companies, the vast majority of employees being fired are not in IT positions, according to industry analysts. In fact, there remains a dearth in tech talent to fill more than 145,000 IT job openings.

IT consultancy Janco Associates offered a somewhat more pessimistic view of the IT job market.

“Layoffs, for the most part, did not hit developers. Rather they were focused on data center operations, administrative and HR roles related to recruiting, and DEI (diversity, equity, and inclusion). Some roles, especially in telecommunications and data center operations are being automated and eliminated,” Janco CEO Victor Janulaitis said in a statement. “Driving this is CIOs and CFOs who are looking to improve the productivity of IT by automating processes and reporting where possible. They are focusing on eliminating non-essential managers and staff. They will continue to hire coders and developers.”

The highest demand, Janulaitis said, continues to be for security professionals, programmers, and blockchain processing IT professionals. Other industry research shows data analysts and AI professionals are also in high demand.

Janco Associates

Janco Associates“The general belief there will be an economic downturn is high for many CIOs and CFOs. This is impacting all decisions around hiring new IP pros and increasing technology-related expenditures,” Janulaitis said.

In 2022, 267,000 new jobs were added to the IT market. Those new jobs were in addition to the 213,000 jobs created in 2021.

In 2023, while there are more jobs being added, that number is declining. In January, for example, for the first time in 25 months, there was a net loss in the number of jobs in the IT Job Market. That trend is continuing, Janco said. In the first two months of 2023, the IT job market shrank by 44,900 jobs.

CompTIA

CompTIA“CIOs and CFOs have started to slow the rate of creating new IT jobs and hiring IT professionals,” Janco said in its report. “The three month moving average for IT job market growth trend for IT professionals shows a significant downward trend. Inflation and recessionary trends are driving this.”

Layoffs and economic uncertainty drove CIOs and CFOs to slow IT hiring in February, according to Janulaitis.

“Layoffs at big tech companies are having an adverse on overall IT hiring. More CIOs are looking at a troubling economic climate and are evaluating the need for increased headcounts based on the technological requirements of their specific business operations,”Janulaitis said.

The growth of the IT job market stopped with a decline of 10,000 jobs in January and 13,400 jobs in February, according to Janco. That was the first loss in the number of IT Pros employed in over 27 months. The three-month moving average of IT job market growth went negative with a trend line that shows a further decay in IT job market growth.”

CompTIA

CompTIAOverall US employment rose by 311,000 jobs in February, the Bureau of Labor Statistics (BLS) said. That was vastly higher than the 225,000 jobs predicted by economists polled by the Wall Street Journal. In January, about half a million jobs were added, according to BLS data.

The number of people quitting jobs (3.9 million) decreased, in February, while layoffs and other firings (1.7 million) increased. Even with the unemployment rate ticking up slightly, are still nearly two jobs (10.8 million) for every unemployed worker (5.9 million), according to a BLS data. In 2022, the annual average number of job openings was 11.2 million.

Last month, U.S. consumer spending also rose to its highest level in over nearly two years.

Across all industries, the number of people who were without jobs for a short period of time (less than 5 weeks) increased by 343,000 to 2.3 million in February, offsetting a decrease in the prior month. The number of long-term unemployed (those jobless for 27 weeks or more), changed little in February and accounted for 17.6% of the total unemployed or 1.1 million people.

Job postings for technology positions rose the most in scientific and tech services industry sector (35,257), finance and insurance (24,735) and manufacturing (20,246).

Overall, in the US job market, the average hourly earnings grew 4.6% year-over-year, which was down from last year but above the pre-pandemic pace, BLS data showed.

The ongoing tech talent shortage also lifted IT salaries, but future pay increases will be less than expected, according to Janco Associates.

On average, IT salaries rose by 5.61% in 2022 and were expected to increase by as much as 8% this year, according to earlier reports by Janco.

“Many CIOs’ 2023 IT budgets planned to increase salaries for IT pros to address the inflationary pressures faced by employees are now being reviewed,” Janulaitis said. “Given these facts, we believe that median salaries for IT pros in 2023 will be 3% to 4% salary above 2022 levels, not the 7% to 8% that was budgeted.”

The mean compensation for all IT pros in 2023 is now $101,323; for IT pros in large enterprises it tops $102,000; and for executives it averages $180,000.

“Companies that do not live up to employees’ expectations may find that even if they are able to get candidates in the door, those candidates leave as soon as a better offer comes along,” Gartner Research analyst Mbula Schoen wrote in a Q&A post this week.. “Additionally, there are increasingly opportunities for IT jobs outside traditional tech companies, so it’s important to look beyond just the tech provider community to truly grasp the state of the tech talent crunch.”

January 2023

The unemployment rate in the technology job market decreased for the second month in a row, dropping to 1.5% in January from 1.8% in December.

Even with the marked drop in unemployment, it was a mixed bag for the technology marketplace, after the U.S. Bureau of Labor Statistics (BLS) issued its January jobs report on Friday. There was a decline in current employment and an increase in employer job postings for potential future hiring, according to CompTIA, a nonprofit association for the IT industry and workforce.

While the overall US unemployment rate dropped to a figure not seen since 1969 (to 3.4%, from 3.5% a month earlier), the number of technology workers hired in January fell into negative territory for the first time in more than two years. Technology occupations throughout the economy declined by 32,000 for the month, representing a reduction of -0.5%, according to CompTIA. Technology companies also shed 2,489 positions in January, according to CompTIA.

CompTIA

CompTIAOverall, however, the US added 517,000 jobs in January, according to BLS numbers.

The BLS also said on Friday it had significantly revised its November data, describing it as a “major revision reflecting content and coding changes.”

In November 2022, the BLS indicated U.S. technology companies added approximately 2,500 net new jobs versus the mistakenly reported decrease of 151,900 jobs in earlier reporting.

CompTIA

CompTIA“The change materially affects the sub-sector of tech companies providing search and platform services, while the revisions were a net positive for sub-sectors such as IT services and data,” CompTIA said.

ComTIA also uses employer online job posting data to predict the number of job postings for future tech hiring, and that number reversed last month’s dip and increased by 22,408 to 268,898 for 2023.

The fact that the unemployment rate in the tech market still dropped in January indicates many laid off workers were re-hired and absorbed back into the labor market, according to CompTIA. The tech unemployment rate is also an indication that many of the layoffs occurring within technology organizations are non-technical workers, such as sales, marketing or related business support positions.

Among industries, the highest volumes of job postings for tech positions were reported in the professional, scientific and technical services (40,712), finance and insurance (30,576) and manufacturing (24,269) sectors.

“Despite the unusual backward revision by the BLS and the routine fluctuations in monthly labor market data, much of the big picture tech employment picture remains the same,” Tim Herbert, chief research officer at CompTIA said in a statement. “Undoubtedly, some companies over- hired and are now scaling back. The low tech unemployment rate and steady hiring activity by employers confirms the long-term demand for tech talent across many sectors of the economy.”

While tech companies shed employees over the past few months in highly publicized reports, overall, 2022 saw an increase of about 264,500 new jobs to the IT job Market, according to IT industry consultancy Janco Associates. Those new jobs were in addition to the 213,000 jobs created in 2021.

In January, the growth of the IT job market stopped with a decline of 4,700 jobs. That was the first loss in over 27 months, according to Janco. The three-month moving average of IT job market growth went negative with a trend line that shows a further decay in IT job market growth. At the same time, there is an excess of 109,000 unfilled jobs for IT Pros due to a lack of qualified candidates.

A lack of qualified candidates has lead to increased demand for tech workers raising overall salaries for all IT positions by 5.6%, with small-and-medium-sized businesses seeing an average increase of 7.74% increase, with their median compensation increasing to $100,434 as reported in Janco’s 2023 IT Salary Survey.

U.S.-based employers announced 102,943 cuts in January, a 136% increase from the 43,651 cuts announced in December, according to global outplacement and business and executive coaching firm Challenger, Gray & Christmas, Inc. That’s 440% higher than the 19,064 cuts announced in the same month in 2022, according to Challenger, Gray & Christmas’s report. Forty-one percent of January’s job cuts were in tech.

Yet demand for those to fill jobs requiring tech skills is rising.

CompTIA

CompTIA“That’s a ton of expertise missing from an industry that needs the brightest to get brighter,” said Vince Padua, CTO at Axway, a tech company that sells an API management platform.

And it’s going to get worse, he added, as 86% IT leaders expect an expertise gap increase in coming years.

“As cloud computing, AI and microservices are developed and adopted, the skills required to support them constantly evolve,” Padua said. “Companies need more employees with the right skills and experience – plus IT infrastructure and enterprise software experts with specialized skills in cybersecurity, data analytics and cloud architecture.”

IT jobs took the top spot in a list of the 25 best jobs in the US, according to online job site Indeed. The top job slot went to full stack developer, which offers a median annual salary of $130,000 and allows for a mostly remote or hybrid workplace..

Eight tech jobs were among the top 10 positions on Indeed’s list this year; that compares with just two tech jobs in the top 10 on last year’s list. In 2022, tech jobs were moving down the top jobs list; now, a year later, tech jobs are surging upward. This year, 11 of the top 25 jobs, or 44%, were tech positions. By comparison, in 2022, just 25% of the top 25 jobs were tech-related.

“Based on our analysis, the IT job market and opportunities for IT professionals are there but not in as broad in scope as in 2022. Layoffs, for the most part, did not hit developers. Rather they were focused on data center operations, administrative and HR roles related to recruiting, and DEI (diversity, equity, and inclusion),” said Janco CEO Victor Janulaitis.

Some roles, especially in telecommunications and data center operations are being automated and eliminated, Janulaitis noted, but those operations will continue to hire coders and developers.

CompTIA

CompTIAThe highest demand continues to be for security professionals, programmers, and blockchain processing IT professionals, according to Janco. Currently, there are over 109,000 unfilled jobs in the IT job market — a drop from 216,000 in November.

Janulaitis blamed continued concern over a possible recession as one reason organizations are eliminating jobs.

“More CIOs are looking at a troubling economic climate and are evaluating the need for increased headcounts based on the technological requirements of their specific business operations,” Janulaitis said.

According to the latest BLS data analyzed by Janco, there are now just over 4.2 million jobs for IT Professionals in the US., and layoffs at big tech companies are having an adverse on overall IT hiring.

“The possibility of the economic downturn is very likely and is impacting all decisions that increase technology-related expenditures. Work from home is being minimized as companies are requiring employees to be in the office at least 3 to 4 days a week,” Janulaitis said. “Mid-level managers are now having to justify most positions where the IT Pro is not working in the office. Companies that are forced to hire replacements, do so with the caveat that payroll costs remain flat. “

The 2023 IT budgets increased salaries for IT pros to address inflationary pressures faced by employees. Those are now being reviewed. Given those facts, Janco believes that median salaries for IT Pros in 2023 will be 3-4% salary above 2022 levels, not the 7% to 8% that was budgeted at the end of 2022.