Edge computing is often predicted as a technology that will revolutionise enterprise computing in Australia. By capturing, processing, analysing and storing data at the edge, instead of a central location, its promises include fast real-time computing at the edge and less cost.

While the edge is yet to live up to these promises, adoption is taking place. Utpal Mangla, general manager for industry edge cloud & IBM Distributed Cloud Platform, said the edge is being rolled out for specific use cases globally, including quality control in manufacturing.

Growth in AI may propel the trend, as some use cases find their way to the edge. Mangla argues a “hybrid cloud by design” approach is the best option for enterprises looking to prepare for a future where they need to straddle on-premises, cloud and edge computing.

Has edge computing fulfilled the full breadth of its promise?

Australia should be a prime candidate for edge computing growth. With a population of 25 million living on a landmass the size of the U.S. or Europe, the potential for processing data at the edge, rather than centralised data centres or the cloud, appears compelling for businesses.

SEE: The current state of edge computing.

But just like elsewhere, the edge has not taken off at the pace some had envisioned.

“The [global] industry has been saying for five, seven, eight years, that it was coming and would change the world,” IBM’s Mangla told TechRepublic. “Has it panned out the way analysts and businesses have seen it? Probably in terms of monetisation, it hasn’t reached that scale yet.”

Monetisation of 5G investments one symptom of slower edge growth

Telecommunications companies like Telstra have put billions into 5G infrastructure. The hope was 5G’s high bandwidth, low latency and capabilities like network slicing would make the promise of the edge real. Monetisation was to be achieved through business customers.

However, a study commissioned by Telstra in 2022-23 described adoption as “nascent” at the time, with just 25% of businesses. It found leaders were exploring cloud adoption and provider investments were fast-tracking customer journeys and advancing hybrid cloud plans.

Global markets show gap between future potential and adoption

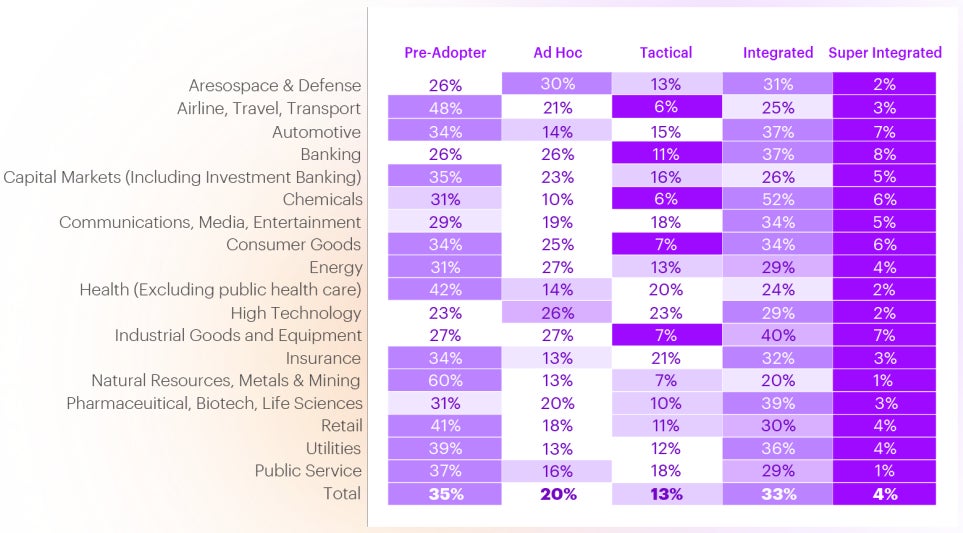

An Accenture survey of 2,100 C-level execs across 18 countries found 83% still believe edge will be essential to remain competitive in the future. However, only 65% were using edge computing, and 50% of these were only “ad hoc” or “tactical” users of edge computing (Figure A).

Why has edge not taken off as much as it could have done?

Slower than expected edge growth was in part due to the hype of predictions themselves.

“Some of it was a bit overblown. It always required building use cases, it required building businesses, it required putting things in place to make that potential of edge computing happen,” Mangla said.

However, there are other barriers the edge computing industry is dealing with in deployment.

SEE: Consider these edge computing best practices.

Return on investment of edge computing business use cases

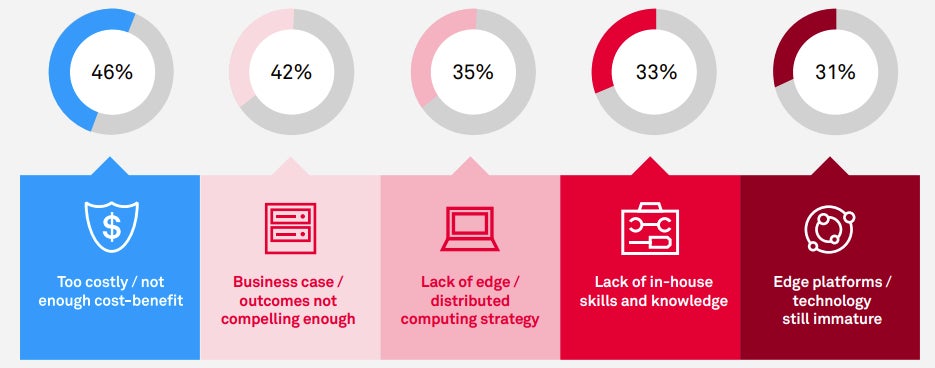

While billed as a way to rationalise costs through a reduction in data transfer costs, the edge has actually turned out to be more expensive in some cases. Telstra’s State of Cloud, Edge and Security 2022-23 survey found 46% of businesses were put off by low cost-to-benefit ratios.

Forty-two per cent found business cases and outcomes not compelling enough (Figure B), which was put down to “insufficient understanding of the benefits of edge in terms of ROI and competitive differentiation.” Businesses were also experiencing edge strategy and skills gaps.

Complexity and extensibility of maturing edge computing technology

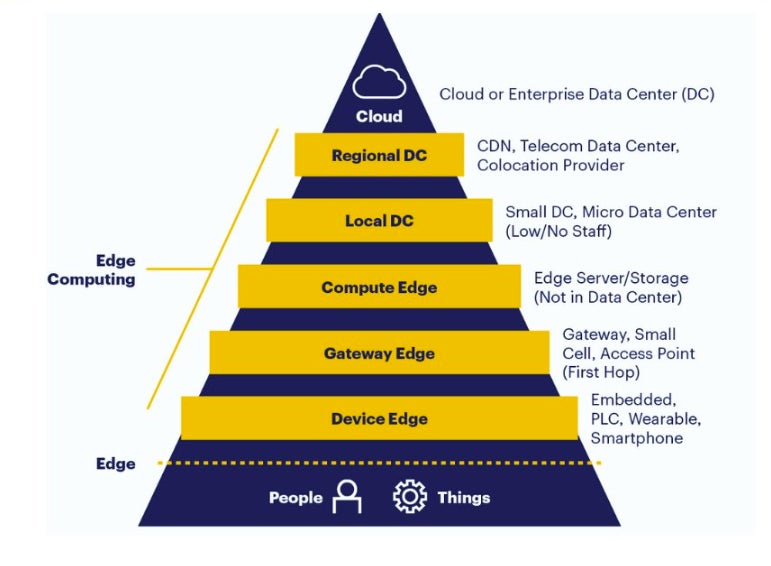

The depth of the edge computing market also means it is challenged by the lack of a standard edge computing stack and APIs (Figure C). This has made it challenging to develop and deploy edge applications that can work across different edge computing devices and platforms.

Use cases for edge computing have tended to be vertical-specific. With differences across industries and use cases, this means investment is also fragmented, at least until individual industries determine consistent architectural approaches to capturing the value of the edge.

Where is the edge finding a useful place in the landscape?

Edge computing is growing in Australia and around the world, even if this may appear underwhelming due to inflated expectations. Mangla noted that edge computing is actively being deployed by IBM clients, in specific industry use cases across the globe.

Manufacturers rolling out edge technologies for the industrial floor

A prime example is on the industrial floor. Mangla said many organisations with manufacturing operations that want top-class quality control and inspection are augmenting manual inspections by deploying edge computing for visual inspection on the shopfloor.

Epicor, a provider of manufacturing execution systems in the Australian and regional market, is just one technology vendor that is actively working with local manufacturers to supercharge operations through smart factory initiatives that further automate operations.

Automotive and mining sectors improve decision making at edge

IBM has worked with automotive clients using the edge to monitor stock levels in car parking lots during supply chain disruptions. The edge is also powering autonomous driving features for automakers, allowing split-second decisions without the latency of cloud connectivity.

Australian miners are leading edge adopters. Iron ore miner Newcrest is using intelligent edge to pull data from downstream sensors monitoring tonnes tipped, apron feeder speeds and weightometres to control the volume of ore delivered to crushed ore bins upstream.

Industries rolling out industry-specific use cases for edge computing

McKinsey & Company research indicates the industries looking at the potential of edge computing include everything from aerospace and defence, the chemicals industry, and electric power, natural gas and utilities, to financial services, healthcare systems and retail.

Could AI accelerate the adoption of edge in Australia?

Australia is ripe for growth in edge computing, Mangla said. During a recent visit to Sydney, he noted there were startups looking to run artificial intelligence visual recognition technology for industries at the edge, and New Zealand companies looking at the edge for their manufacturing operations.

SEE: Australia is well-positioned to capitalise on the future influence of AI.

Mangla said edge computing could be accelerated thanks to AI because some use cases suit the edge. Mangla said the edge really excels where decisions need to be taken fast at that point in time and where it is best to avoid waiting on data to be transferred to centralised locations.

‘Hybrid cloud by design’ mindset will support Australian edge computing

Organisations looking to make the most of edge computing, as well as the rest of their cloud infrastructure, should take a “hybrid cloud by design” approach, Mangla said. While much of the market had stumbled organically into a mix of on-premises and cloud infrastructure and services, he said this would be better managed with an intentional embrace of hybrid cloud in the future.

“When you think about strategy, there is always going to be more than one cloud,” he said. “You will always have something, the crown jewels, that you will never put in a cloud environment, you will always have that in an on-prem or in a private cloud. Australian Government agencies like the ATO, they will never put anything on the public cloud.

“As new applications get built, make sure that application can seamlessly operate across … the entire landscape. As you start building it intentionally over the next 10 to 15 years, as you do app modernisation, you need a hybrid cloud by design mindset.”